RCBC’s AI-driven customer experience transformation

How AI-powered automation redefined customer service and efficiency

600K+

Conversations deflected annually

$22M

Cost reduction from AI agents

80%

AI agent adoption increase

Banking

5000+ Employees

APAC

Introduction

Rizal Commercial Banking Corporation (RCBC) Credit is one of the Philippines’ leading financial institutions, serving over 1.2 million credit cardholders. As customer interactions skyrocketed, the bank sought a scalable, AI-driven approach to manage rising support requests while maintaining exceptional customer service.

Since 2019, RCBC Credit has been on an AI transformation journey, partnering with Kore.ai to introduce Erica, an AI-powered virtual assistant. Today, Erica handles over 600,000 customer interactions, driving cost savings, improving customer experience, and reshaping the bank’s service model.

The Challenge

Before AI adoption, RCBC faced:

The Solution

Introducing Erica – The AI agent

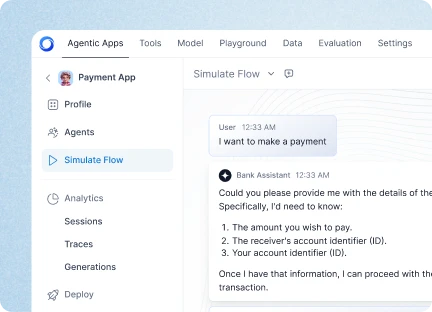

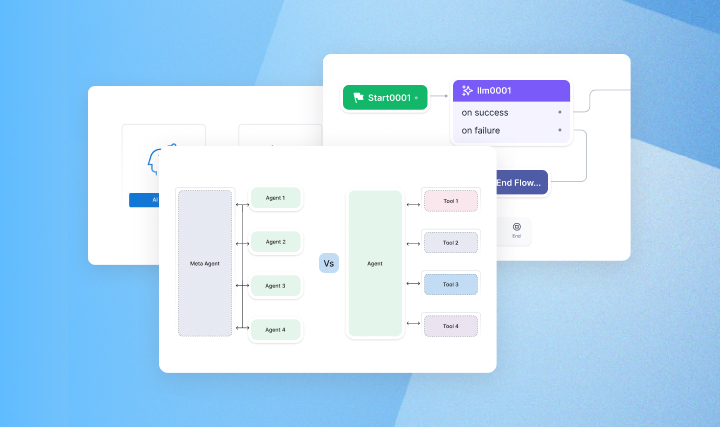

RCBC partnered with Kore.ai to develop Erica (Electronic RCBC Interactive Customer Assistant), a chatbot designed to handle customer inquiries across multiple digital channels.

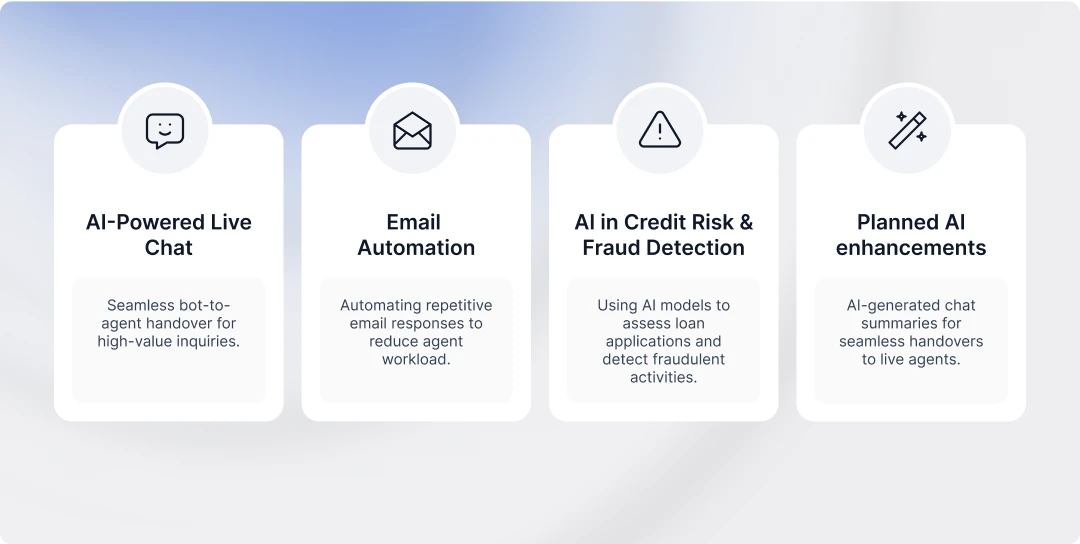

- Launched in July 2021, Erica started with 4 use cases and has now expanded to 9+ key customer service functions. The AI assistant provides instant resolutions for balance inquiries, card activation, rewards redemption, and FAQs.

Business Impact

1. Massive cost savings and ROI

- Erica deflected 600,000 conversations from human agents in 2023, leading to PHP 22 million in cost savings.

- ROI was achieved within the first year, faster than initially projected.

2. Improved customer experience

- 80% increase in chatbot adoption after integrating rewards redemption.

- Customer satisfaction (CSAT) in AI-powered CX journeys now outperforms traditional channels.

3. AI-augmented workforce and efficiency gains

- Agents spend more time on complex customer needs, as Erica manages repetitive inquiries.

RCBC Credit continues to expand AI applications beyond customer service

Key takeaways for enterprises adopting AI

1. Gen AI is table stakes

- Scaling customer service and experience without hiring more agents is only possible with AI.

2. Strategic adoption leads to rapid ROI

- RCBC saw cost savings within a year and continues to expand AI use cases.

3. Customer education & AI adoption go hand in hand

- Promoting AI-powered services through marketing and agent guidance drove adoption by 80%.

Collaboration with AWS

For RCBC’s AI Agents for Service deployment, Kore.ai built a resilient, secure customer engagement platform on AWS that supported high-transaction digital service experiences and robust governance. The solution leveraged Amazon EKS for orchestrating scalable AI microservices, Amazon S3 for encrypted and durable storage of interaction data, and AWS Key Management Service (KMS) for enterprise-grade encryption key control. Intelligent conversational workflows were delivered using Amazon Bedrock, while AWS CloudWatch, AWS WAF, and Amazon Route 53 ensured real-time observability, threat protection, and traffic management for mission-critical banking workloads.

.webp)